I would tell that the list of stocks I’m never going to sell is very brief. Currently the only one might be Amazon.com (NASDAQ:AMZN).About every organisation is seeking to grow. If or until these growth opportunities plateau and sales continue to stagnate, they appear to concentrate on optimising existing sales and replenishing cash through dividends and/or repurchases of shareholders. This is typically the logical choice because there are few options to spend capital in their own firms.

When a corporation goes into expansion at the cost of existing profits yearly, re-investing nearly all its resources, it’s a whole new ball game. In its 1997 letter to shareholders, Amazon’s founder and CEO Jeff Bezos wrote, ‘If we plan to optimise current value from potential cash flows and optimise our GAAP appearance, we are going to have the cash flows.’

Being prepared to trade short-term profits for investment in development was not so usual when the Amazon arrived. As a consequence, the corporation has long been mistaken. A journalist known it as “a charity corporation run by financial group elements to support customers.”

In reality, Amazon is prepared to reinvest and attempt (and likely fail) in its new projects. And it’s got its share of setbacks definitely. A high profile flop was the firephone. It has attempted to enter the online travel game at least twice without success. By offering high performing gems several years back, Amazon sought to deal with Blue Nile. It tried also to compete with eBay and create a failed online auction firm.

However, these mistakes are worthwhile. To be able to take chances, Amazon has succeeded tremendously in creating major new firms. This ultimately crashed online auctionNo popular Amazon corporations from day one is fine. To get it right, they must be iterated and refined. Imagine how much less Amazon will be now as an enterprise because it was able to face failure. It is because of the preparation, which also allows massive progress, that I’m never going to sell my Amazon shares.

Core Industries Are Also Really Early

Core e-commerce and cloud firms in Amazon are dominant, but they are both both at their early stages. Remember the spectacular scale of the world retail market: 25 trillion dollars. Due to Amazon’s ability to spend, no organisation is in a stronger position to attack this market during time.

The e-commerce firm of Amazon has ceased to be solely involved. It experiments aggressively with physical shopping models such as the Amazon Go comfort stores with their future-oriented “only go out” technology.

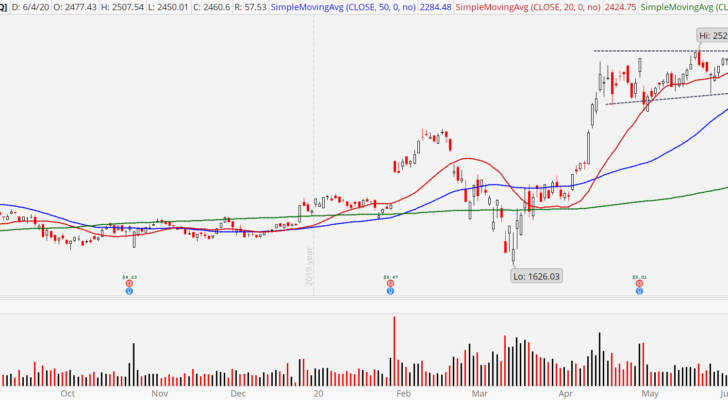

Amazon Go food stores and NASDAQ:AMZN New food stalls are also opening. It has checked many other physical models such as bookstores, 4-star Amazon shops and others. Thus, while e-commerce will almost unavoidably continue to grow its share of the global retail market and profit Amazon will also extend into the immense physical retail environment. If you want to invest in this stock, you can check cash flow at https://www.webull.com/cash-flow/nasdaq-amzn .

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.